Under tight schedules and competing goals, staying intentional with money avoids stress and waste. Start managing Finances Easily With the YNAB App, align spending to priorities, and replace guilt with clarity.

Zero-based budgeting gives every unit of income a clear role, so dollars stop drifting into impulse decisions. Expect a calmer routine once planned categories, simple targets, and quick check-ins keep cash flow predictable.

Why YNAB Works for Real Budgets

In practice, YNAB focuses on money already in your accounts rather than guesses about the future.

Plans become realistic because each category reflects a current balance and a job to do before fresh income arrives.

Moving money between categories stays easy, so adjustments feel deliberate instead of chaotic. That flexibility reduces overspending hangovers and builds confidence in daily choices.

The YNAB Method in Four Rules

Clear rules translate budgeting theory into everyday actions that hold up month after month. Treat the rules as habits rather than rigid constraints, since life events require frequent course corrections.

YNAB formally teaches four principles, assign every dollar, plan non-monthly expenses, adjust in real time, and age funds ahead of bills.

During late 2024, the company also reframed these principles into guiding questions while keeping the core behaviors intact.

Give Every Dollar a Job

Assign every dollar to a category that matches an immediate or near-term need. Checking the category balance before spending prevents “available money” confusion at the account level.

Rent, groceries, debt payments, and fun money each get an explicit allocation tied to timing. That clarity reduces second-guessing and improves tradeoffs during the month.

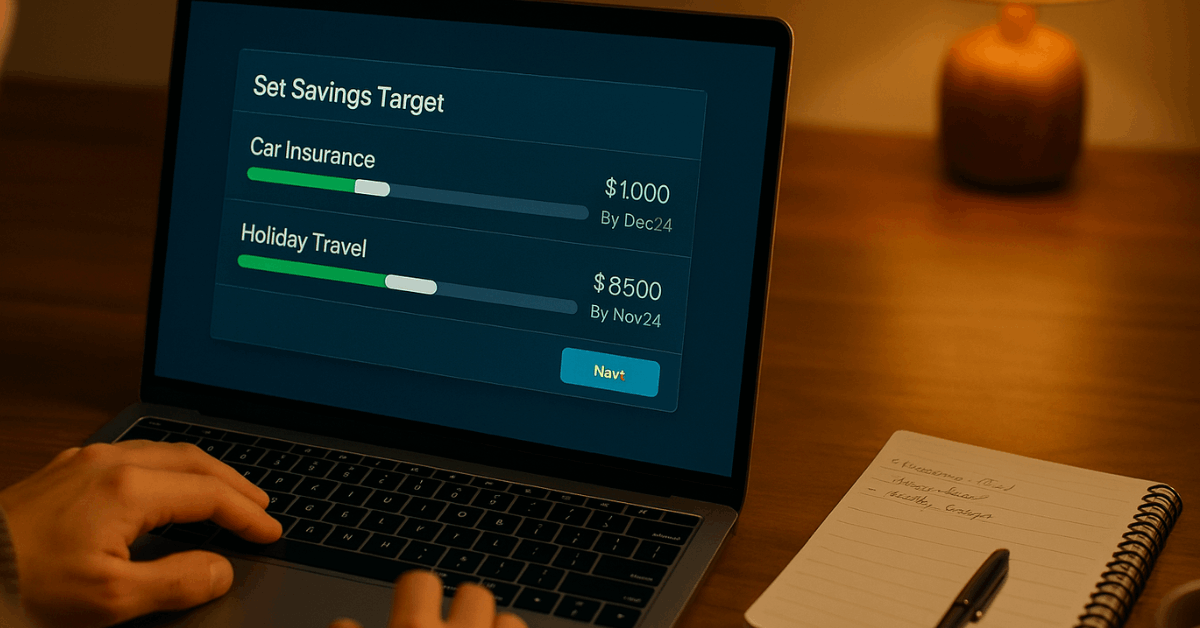

Embrace Your True Expenses

Break irregular costs into monthly set-asides so annual or quarterly bills never become emergencies. Car insurance, holiday travel, tuition fees, or appliance repairs sit in categories funded a little at a time.

Treat these as non-monthly expenses that still deserve predictable contributions. Stress drops because the cash sits ready when due.

Roll With the Punches

Budgets remain living documents that change as needs change. Reassign category dollars when plans shift, rather than letting overages accumulate silently.

Intentional reallocation maintains momentum without abandoning broader goals. YNAB’s materials emphasize this flexible habit repeatedly.

Age Your Money

Create distance between earning and spending so bills get paid using older dollars. As buffers grow, bill timing stops controlling your week, and decisions become less reactive.

Many users target one full month of expenses as a working cushion. YNAB explains this concept as a cornerstone of calmer money management.

Build a Working Plan in 30 Minutes

Strong execution starts with a simple workflow that moves from setup to first assignments quickly.

Plan to gather recent statements, decide on budget categories, and connect everyday accounts. Keep the scope tight for day one, then refine during real usage. Consistent action beats elaborate planning that never gets used.

- Connect everyday accounts for bank account linking: Link checking, savings, and frequently used credit cards, or enter balances manually if preferred. Direct import supports many banks in the US, Canada, UK, and EU, while file import works elsewhere.

- Customize categories to mirror real life: Add housing, utilities, transport, subscriptions, and lifestyle items that genuinely appear in your month. Keep the list readable by grouping essentials, savings, and discretionary items.

- Set starter targets per category: Enter monthly or date-based amounts for rent, insurance, holidays, or back-to-school costs. Estimation is fine initially because targets can be raised or lowered later without penalty.

- Assign every dollar on day one.: Work to zero using income already received and leave nothing unplanned. Treat this as assign every dollar discipline rather than a loose guideline.

- Review and adjust twice weekly: Reallocate to cover overspends, confirm recent imports, and keep the plan trustworthy for the next decision.

Targets, Goals, and Non-Monthly Funding

Because irregular bills derail many budgets, scheduled targets keep cash flowing toward upcoming obligations. Monthly contributions to lumpy costs build predictability, and visual progress reinforces momentum.

Consider adding a few joy categories as well, since planned treats reduce later splurges. The table shows concise examples you can adapt immediately.

| Category | Target Type | Example Amount | Timing |

| Car insurance | Date-based total | $900 | Every 12 months |

| Holiday travel | Monthly contribution | $150 | Each month |

| Emergency fund | Monthly contribution | $200 | Each month |

| Laptop replacement | Date-based total | $1,200 | In 10 months |

| Annual subscriptions | Date-based total | $300 | In 6 months |

Daily Habits That Keep the Plan Accurate

Small routines keep the plan useful without becoming a chore. Quick check-ins prevent backlog, while rules of thumb accelerate categorization and coverage decisions. Most users settle into a five-minute rhythm that pairs nicely with morning coffee.

- Record transactions promptly: Enter expenses in the mobile app at checkout or confirm imported items the same day.

- Watch category balances before spending: Check the dining or fuel category first, then swipe with confidence.

- Cover overspends immediately: Move dollars from lower-priority categories to protect cash flow and avoid interest.

- Fund true expenses first: Prioritize irregular bills and safety buffers before optional upgrades or treats.

- Review targets monthly: Increase or pause contributions as bills, income, or priorities evolve.

Security, Pricing, and Trial Details

Because sensitive financial data deserves strict safeguards, YNAB enforces encrypted connections in transit and at rest, and blocks non-encrypted browser sessions. Official guidance details bank-grade encryption and secure account authentication flows.

As of October 2025, new users receive a 34-day free trial, and no credit card is required when signing up directly on the YNAB website.

Subscriptions cost $109 USD per year (or $14.99 month-to-month), with taxes where applicable. Supported direct import regions include the US, Canada, UK, and EU; file-based import remains available globally.

Common Mistakes to Avoid

After connecting accounts, leaving dollars “unassigned” undermines clarity and invites accidental overspending. Assign everything the day income arrives, even when exact amounts feel uncertain.

Another common error involves ignoring true expenses until renewal emails appear; monthly set-asides prevent that scramble entirely.

Finally, chasing perfection slows progress, so start with rough targets, adapt weekly, and let the method’s questions guide improvements over time.

Conclusion

Across busy seasons and irregular pay cycles, intentional planning beats willpower every time.

Treat YNAB as a budgeting app that enforces zero-based budgeting, nudges focus toward priorities, and keeps stress low through quick adjustments.

Consistent check-ins, realistic targets, and flexible reallocations lead to steady progress without lifestyle whiplash. Start small, protect true expenses, and age your money so bills arrive to funds already waiting.