PayPal makes sending and receiving money fast and convenient. You can use it to move funds instantly between accounts, banks, and cards.

The process is secure, simple, and ideal for both personal and business use. This guide explains everything you need to know to transfer money instantly using PayPal.

Understanding PayPal Instant Transfers

Instant transfers let you send or withdraw funds within minutes. Before using this feature, you need to understand how it works and what affects its speed.

What Is an Instant Transfer?

An instant transfer allows money to move immediately from your PayPal balance to a linked debit card or bank.

Unlike standard transfers, which take one to three days, instant ones complete in seconds.

To qualify, your account and card must meet PayPal’s verification standards. This feature is perfect when you need funds available right away.

PayPal Balance, Bank, and Card Transfers

PayPal gives you several options for sending money. You can use your PayPal balance, linked card, or connected bank account.

Each method has different speeds—balance transfers are usually the fastest. Choosing the right one helps you avoid delays and unnecessary fees.

Fees and Transfer Limits

Instant transfers charge a small fee, typically a percentage of the total sent. Verified accounts enjoy higher limits and faster processing.

Unverified users may experience restrictions and delays. Keeping your account information updated helps prevent transaction issues.

Setting Up Your PayPal Account for Instant Transfers

Setting up your account correctly ensures smooth and fast transfers. You need to link and verify your payment sources before using instant transfer.

Linking Your Bank Account or Card

Start by linking your debit card or bank account through the PayPal dashboard. Add accurate banking details to avoid verification errors.

PayPal may send a small deposit to confirm ownership. Once verified, your card or bank becomes eligible for instant transfers.

Verifying Your Identity

PayPal requires identity verification for security and compliance. Upload a government-issued ID and verify your address to unlock higher limits.

This process helps protect your account from fraud and ensures safe transactions. Once verified, transfers become faster and more reliable.

Setting Up Two-Factor Authentication

Enable two-factor authentication (2FA) to secure your account. Each login will require a code sent to your phone or email.

This prevents unauthorized access even if someone knows your password. PayPal encourages all users to use this feature for safer transfers.

How to Transfer Money Instantly?

Sending money through PayPal is simple when your account is verified. These steps show how to move funds instantly using the app or website.

Sending Money via PayPal App

Log in to your PayPal app and tap “Send.” Enter the recipient’s email or phone number, then the amount. Choose “Friends and Family” for personal transfers to avoid fees.

Confirm your payment method and tap “Send Now” to complete the transaction instantly.

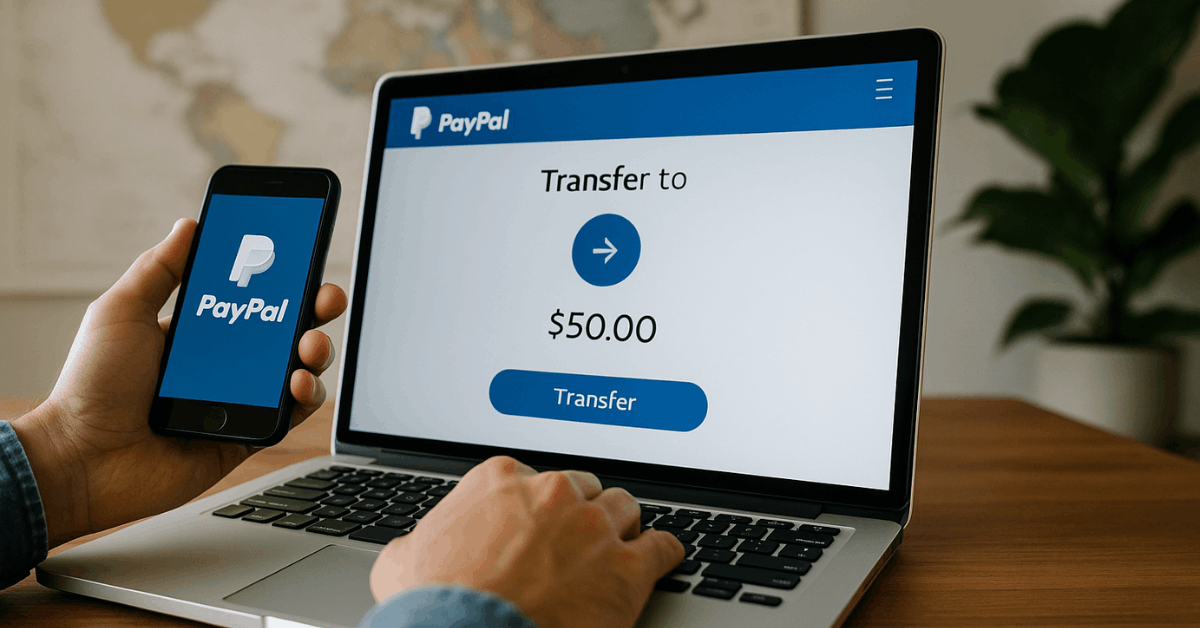

Transferring to a Bank or Debit Card

Go to your PayPal balance and select “Transfer.” Choose your bank or debit card for instant transfer.

Review the small fee before confirming. Funds will usually appear in your account within minutes.

Sending to Friends and Family

For personal payments, use the “Friends and Family” option. It’s quick, free when using your PayPal balance, and available globally.

However, business payments should use the “Goods and Services” option. This ensures transaction tracking and buyer protection.

Troubleshooting Delays or Failed Transfers

Sometimes instant transfers face delays or fail to process. Understanding the cause helps you fix the issue quickly.

Common Reasons for Delays

Delays happen if your account isn’t verified or your bank is under maintenance. Incorrect details or system checks may also slow the process.

PayPal sometimes reviews transactions for security reasons. Keeping your info accurate reduces the chance of this happening.

What to Do if Transfer Fails?

Check your transaction status in PayPal’s “Activity” section. If it’s pending or failed, contact your bank or PayPal support.

Avoid resending funds until you confirm the issue. Refunds for failed transfers usually return to your balance automatically.

Avoiding Future Issues

To prevent problems, verify your bank and card regularly. Keep your PayPal app updated to ensure compatibility.

Avoid transferring during system maintenance hours. Consistent account management keeps your transactions smooth.

Security and Privacy Measures

Every instant transfer is protected by advanced security tools. PayPal prioritizes user safety and data privacy.

Encryption and Buyer Protection

PayPal encrypts all transactions to keep your financial details safe. It also offers buyer protection for purchases made through “Goods and Services.”

This ensures refunds if a product doesn’t arrive or matches the description. Security is automatic and applies to eligible payments.

Protecting Your Account

Watch out for phishing emails or fake PayPal pages. Always check the sender’s address before entering login details.

Report suspicious messages directly from your account settings. Enabling notifications helps detect unauthorized activity early.

Advantages of Using PayPal for Instant Transfers

PayPal provides multiple benefits for instant transfers. These make it a preferred tool for global and domestic transactions.

PayPal supports over 200 countries and major currencies. It works seamlessly for online shopping, subscriptions, and freelance payments.

Instant transfers are ideal for emergency situations or quick payments. The platform’s reliability makes it a top choice among digital payment users.

Alternatives and Integrations

PayPal integrates with several other services for wider flexibility. You can also explore alternatives that offer similar instant transfer options.

Using PayPal with Venmo or Xoom

Venmo and Xoom are PayPal-owned platforms offering different functions. Venmo suits peer-to-peer transfers, while Xoom specializes in international remittances.

Both link easily with PayPal accounts. Using them expands your options for sending money worldwide.

Other Instant Transfer Options

Apps like Cash App, Zelle, and Wise also provide fast transfers. Cash App is popular in the U.S., while Wise focuses on affordable cross-border payments.

Zelle works directly through major banks. You can compare fees and speeds to choose the best service for your needs.

Tips for Faster and Cheaper Transfers

A few smart habits help you send money more efficiently. Follow these to save both time and cost.

- Verify your account early to increase transfer speed and limits.

- Use your PayPal balance instead of credit cards to avoid fees.

- Transfer during business hours to minimize banking delays.

- Double-check recipient details to prevent sending errors.

- Keep your app updated for the latest speed and security improvements.

Conclusion: Master Instant Transfers with PayPal

PayPal gives you the power to send money instantly and securely anytime. Setting up your account correctly ensures smooth, error-free transfers.

Understanding fees, verification, and troubleshooting keeps your transactions efficient. When used wisely, PayPal becomes one of the most reliable tools for instant financial transfers.